Get a Personal Loan in Toronto

Need a personal loan? Scroll down to see some of the best loans available in Toronto. Not sure if you will qualify based on your credit score? Use Borrowell to check your Equifax credit score for free and instantly find out your approval chances. Sign up for Borrowell, compare loans, and apply with confidence!

How to Get a Personal Loan in Toronto

Over 170,000 Toronto residents have signed up for Borrowell to check their free credit score and quickly compare loan offers that they qualify for. By using Borrowell, these users have seen their average credit score improve by approximately 17 points. Sign up today to get your free credit score, quickly apply for the right loan, and improve your long-term financial health.

Personal Loans Toronto: What You Should Know

In general, there are two main kinds of online personal loans available: secured and unsecured. A secured personal loan uses an asset, like a car or home, as a form of collateral to ensure the lender you will pay back the loan. With an unsecured loan (one of the most popular forms of personal loans in Toronto) the lender does not secure repayment of the loan with collateral. Because there is no collateral to guarantee loan repayment, unsecured loans may require better credit scores and charge higher interest rates than secured personal loans.

Different types of personal loans that can be either secured or unsecured include debt consolidation loans, home repair loans, credit building loans, emergency loans and more.

While lenders have different criteria, generally, online lenders in Toronto require proof that potential borrowers:

Are a Canadian resident with a permanent address

Are 18 years old or older

Have a regular income with consistent employment history

Have a Canadian bank account

Have at least one-year credit history

The majority of lenders will also check your credit score and credit history to confirm that you are creditworthy and will repay the loan.

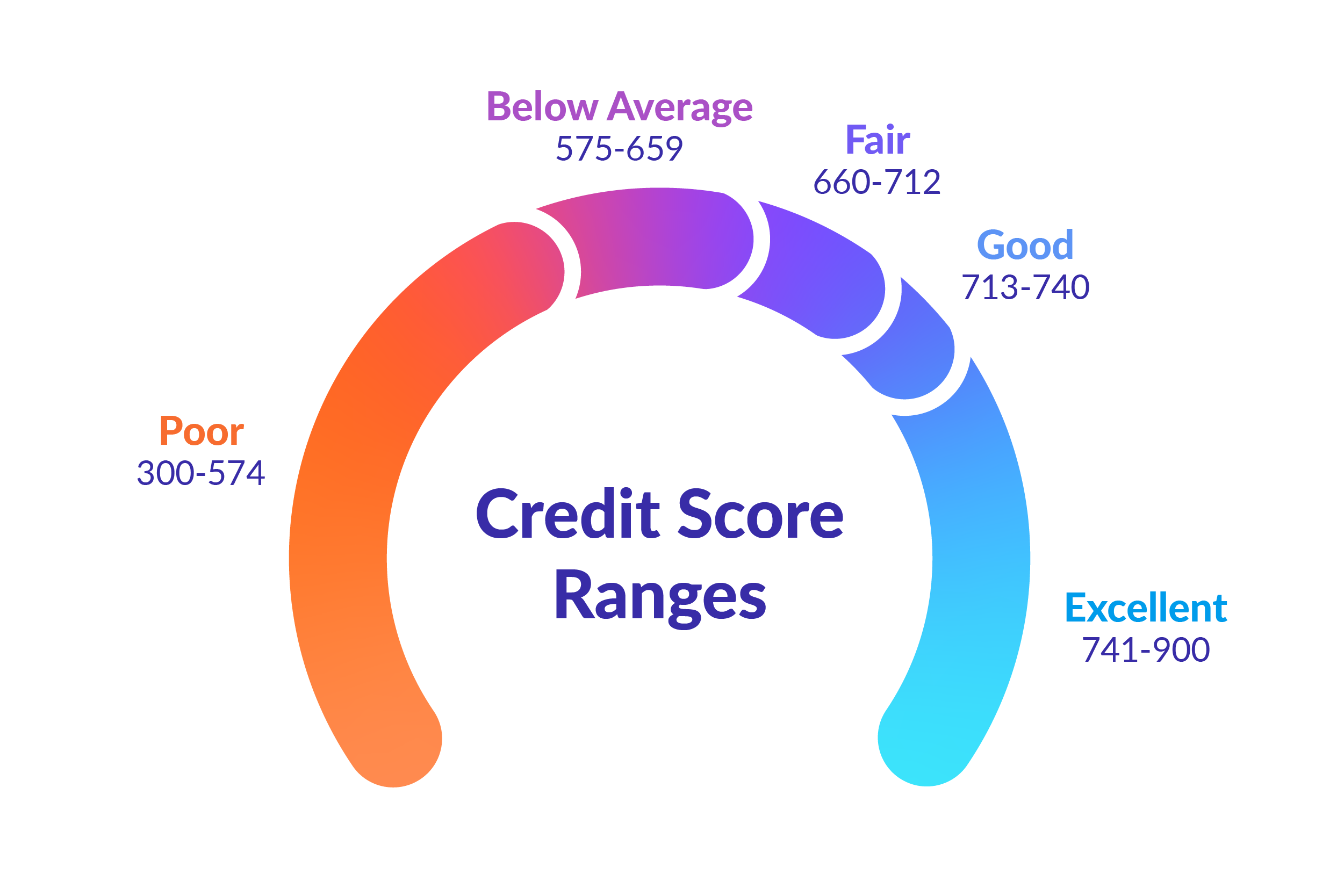

In Canada, credit scores comprise a three-digit number that ranges from 300 to 900. Different lenders have different minimum required credit ratings for loan approval. The higher your score, the more likely you are to get approved for a loan. A general guideline is that credit scores over 660 have the best chance of getting approved.

If your credit score is below 660, there are still personal loan options available. With Borrowell, you can check your credit score for free. Sign up for Borrowell to see what loan options are available based on your credit score.

Many people don’t realize that getting a loan can actually help improve your credit score. Payment history makes up 35% of your credit score. As long as you manage the loan responsibly and make regular payments and your lender reports your payments to a credit bureau, your credit rating will improve.

There are many reasons you may not get a loan. A common reason not to get approved for a loan is that you provided inaccurate information during the application process. It may be a simple error like unknowingly giving the wrong banking info or employment details. It could be that there were some “red flags” on your credit report. Some of these could include:

Your credit score is too low

Your credit history is not long enough (at least 12 months is the norm),

You miss bill payments consistently

You have a bankruptcy on record

You are carrying too much debt

These reasons stated above could make lenders nervous that you won’t be able to pay back a loan.

Why You Should Check Your Credit Score First

Lenders qualify you based on your credit score

Your credit score is one of the main criteria for qualifying for a personal loan. Because of this, you should find out what your actual credit score is before applying for a loan. With Borrowell, you can check your credit score for free before applying for a loan.

Applying for a new loan affects your credit score

When you apply for a loan and a lender checks your credit score, it is recorded on your credit report as a “hard inquiry.” Hard credit inquiries temporarily lower your credit score, so it’s in your best interest not to apply for multiple financial products in a given time frame.

Borrowell shows you your likelihood of approval for each loan

To minimize impacts to your credit score, you want to make sure you apply for a loan that you're confident you'll get approved for. Borrowell helps protect your credit health by showing you your likelihood of approval for the loan products recommended to you on our platform, based on your credit score.

Borrowell's Quick & Easy Loan Process

Sign Up & Get Your Score For Free

When you sign up to Borrowell, you’ll get your free Equifax credit score free in just three minutes. Checking your score won't impact it, and you can see which loans you will be eligible for.

Check Rates & Choose Your Offer

Borrowell automatically matches your credit profile with the best loan products available based on your credit score. Select your offer and complete the online application.

Get Your Loan

Once your personal loan is approved by a Borrowell loan partner, you can usually access your funds in just a few days.

Is Signing Up for Borrowell Free?

Yes, it's really free. Borrowell provides you with your Equifax credit score, free of charge. Based on your credit score, we provide you recommendations on the best loans, credit cards, and financial products that you are likely to qualify for. Knowing your credit score speeds up the loan application process and helps you get your money as quickly as possible.

Still Have Questions?

Get More Answers

Some personal loan options in Toronto can range from $500 up to $35,000. Most companies that provide loans in Toronto have a standard minimum and maximum amount they are willing to loan. The amount that you will receive depends on a variety of factors, including your credit history, credit score, income, amount of debt you already have and whether or not you have collateral.

There are really no restrictions on how you can use your loan. Common reasons that people use personal loans for include:

Home renovations

Unexpected emergency expenses

Vacations

Debt consolidation

Unexpected vehicle repairs

The online application process for loans in Toronto is quite straightforward. The lenders will carefully look through the information you provide (like your income and bank information) to see if you qualify for a personal loan. They will also check your credit score and credit history to confirm you are creditworthy. Once they confirm that you are eligible for a loan, they will approve you for a set loan amount. They will then also discuss any potential fees, interest rates and a repayment plan that will cover how often you will make payments over a set number of years.

The best way to compare personal loans and interest rates is by using a platform like Borrowell that provides access to a wide variety of online loan providers. Rather than just getting a quote for a loan from one provider, a loan comparison platform lets you compare offers from many lenders so you can be sure you’re getting the most competitive rates and repayment terms for personal loans in Toronto.

Borrowell only recommends loan offers from lenders that you would qualify for based on your credit score. Sign up for Borrowell to see what loan options are available to you.

An interest rate is the amount the lender charges you for borrowing money. There are numerous ways to calculate interest rates. In your loan agreement, the lender will tell you if the interest will be calculated on a daily, monthly or annual basis. Usually for loans in Canada, the interest is displayed on the loan agreement as an annual percentage rate. An annual percentage rate is the amount of interest you’ll pay on your loan amount during the course of one year.

A fixed interest rate means that the rate of interest you will pay on the loan will stay the same throughout the entire length of your loan term. Essentially, the interest rate is “locked in”. A variable interest rate means that the rate of interest is not guaranteed to remain stable. The rate will fluctuate throughout the entire term of the loan depending on market conditions.

Having a variable rate could be a good idea if you think that interest rates will go down in Canada. However, you also risk a significant increase in your interest rate payments if rates increase. With a fixed rate, you have more stability and you don’t have to worry about your loan payments changing.

Timelines vary, but the application process to get a loan usually takes 1 to 2 business days. However, if there are issues verifying the details you provided on your application, such as bank information, it could take an additional 1 to 2 business days. Usually your loan amount will be deposited directly into your bank account, though it can also come in the form of a cheque.

Loan terms tend to vary based on the lender and can range anywhere from 6 to 60 months. Normally, however, lenders in Canada frequently offer 3- and 5-year terms. A shorter term is generally more desirable because you will end up paying less interest over the course of your loan.

Depending on your lender, you can pay back your loan by making bi-weekly (every two weeks) or monthly payments. Many people prefer to have one monthly payment as it makes it easier to manage your cash flow and organize your personal finances. The amount you owe will be debited from your account automatically.

An unsecured loan means that you don’t have collateral (like a car or house) to guarantee repayment of the loan. Because you can’t use collateral to secure your loan, unsecured loans tend to have higher interest rates than secured loans.

How Borrowell Can Help with Your Financial Goals

Monitor & Track

Sign up and get your free Equifax credit score in just 3 minutes. Checking your score won't hurt it!

Understand & Improve

Receive weekly updates on how your credit score has changed. Get personalized tips on how you can improve your credit health.

Find the Right Product

Get matched automatically with the right loan products and trusted lenders that match your credit profile. Select your offer and complete the online application through the platform.

Find a Personal Loan in Toronto with Borrowell

Ready to find the best personal loan in Toronto? Sign up for Borrowell to get your free credit score, receive personalized loan recommendations based on your score, and quickly apply for a loan today!